Summary:

The macro data from the past month continues to mostly point to positive growth

. On balance, the evidence suggests the imminent onset of a recession is unlikely.

One concern in recent months had been housing, but revised data shows housing starts breaking above the flattening level that has existed over the past two years. A resumption in growth appears to be starting. That said, housing starts grew only 1% in the past year. Permits are up only 2%. This data bears following closely.

That leaves two watch outs. The first is employment growth, which has been decelerating from over 2% last year to 1.6% now. It's not alarming but it is noteworthy that expansions weaken before they end, and slowing employment growth is a sign of some weakening that bears monitoring.

The second watch out is demand growth. Real retail sales excluding gas is in a decelerating trend. In April, growth was just 1.6% after having grown at more than 4% in 2015. Personal consumption accounts for about 70% of GDP so weakening retail sales bears watching closely.

Overall, the main positives from the recent data are in employment, consumption growth and housing:

- Monthly employment gains have averaged 186,000 during the past year, with annual growth of 1.6% yoy. Full-time employment is leading.

- Recent compensation growth is among the highest in the past 8 years: 2.6% yoy in 1Q17.

- Most measures of demand show 2-3% real growth. Real personal consumption growth in April was 2.6%. Real retail sales (including gas) grew 2.2% yoy in April, making a new ATH.

- Housing sales made a 9-1/2 high in March. Sales grew 1% yoy in April. Starts grew 1% over the past year.

- The core inflation rate is ticking higher but remains near the Fed's 2% target.

The main negatives have been concentrated in the manufacturing sector (which accounts for less than 10% of employment). Note, however, that recent data shows an improvement in manufacturing:

- Core durable goods growth rose 6.0% yoy in April. It was weak during the winter of 2015-16 but has rebounded in recent months.

- Industrial production rose 2.2% in April, helped by the rebound in mining (oil/gas extraction). The manufacturing component grew 1.9% yoy in April.

Prior macro posts are

here.

* * *

Our key message over the past 5 years has been that (a) growth is positive but slow, in the range of ~2-3% (real), and; (b) current growth is lower than in prior periods of economic expansion and a return to 1980s or 1990s style growth does not appear likely.

Modest growth should not be a surprise. This is the typical pattern in the years following a financial crisis like the one experienced in 2008-09.

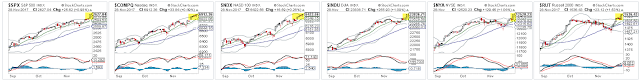

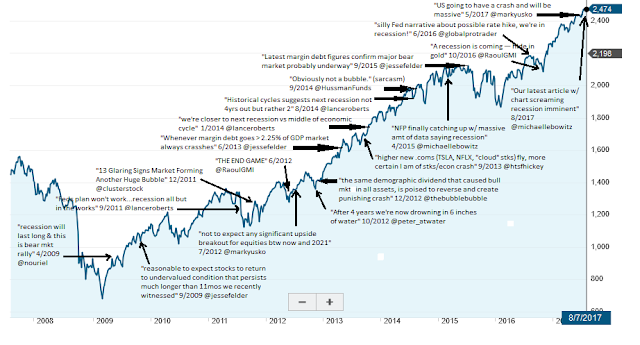

This is germane to equity markets in that macro growth drives corporate revenue, profit expansion and valuation levels. The saying that "the stock market is not the economy" is true on a day to day or even month to month basis, but over time these two move together. When they diverge, it is normally a function of emotion, whether measured in valuation premiums/discounts or sentiment extremes. Enlarge any image by clicking on it.

A valuable post on using macro data to improve trend following investment strategies can be found

here.

Let's review each of these points in turn. We'll focus on four macro categories: labor market, inflation, end-demand and housing.

Employment and Wages

The May non-farm payroll was 138,000 new employees minus 66,000 in revisions. In the past 12 months, the average monthly gain in employment was 186,000. Employment growth is decelerating.

Monthly NFP prints are normally volatile. Since the 1990s, NFP prints near 300,000 have been followed by ones near or under 100,000. That has been a pattern during every bull market; NFP was negative in 1993, 1995, 1996 and 1997. The low print of 50,000 this March, 86,000 in March 2015 and 43,000 in May 2016 fit the historical pattern. This is normal, not unusual or unexpected.