* * *

2016 is off to rough start. In fact, equities have never had a worse start to the year than they have so far in 2016. For the week, SPX fell 6%. NDX and Europe both fell 7%. Volatility (VIX) rose nearly 50% to its highest weekly close since the August low in equities.

Choose whatever narrative you like for the fall in equities: rate hikes, China, oil or valuations. For the week, oil fell 11% to its lowest level in more than 10 years. This certainly contributed to the pressure on equities.

That equites fell more than 5% is not that surprising. In our final post of 2015, we warned that US equities have sold off by more than 5% after each of the last 4 rate hike cycles began (read: If Santa Comes, Fade Him).

But, while the sell off itself is not atypical, the speed with which it has taken place has been astounding. 6% falls in one week are relatively rare. Outside of the depths of the 2008-09 bear market, falls like the past week have happened only 5 other times in the past 10 years.

What is notable in the chart above is that none of these marked the low; momentum carried price lower at least intra-week in the day(s) ahead.

The fall knocked the indices below support. The leader, NDX, lost two levels of support, including a key one at 4400. A lot of technicians are now looking for a retest of the August/September lows, 5% farther down.

Certainly, oversold can become more oversold, but when RSI(5) is at Friday's level of 10, NDX has been very near a level where it bounces hard (green lines).

SPY has the same set up as NDX. It lost both key support at 200 and 197.5, which now become important resistance levels on any rebound. August/September lows are about 3% lower. RSI is at a level where a vicious bounce can take place.

Putting the charts above together, a reasonable expectation is that momentum carries the indices lower to start the coming week, but a counter move higher is probably near.

Indices do not often hit a durable low at the end of the week; it's more likely to happen at the start of the next week. That makes sense, as nervous investors are not interested in taking weekend risk (data from Sentimentrader).

Note in the chart above that January is the least likely month for equities to form a durable low. This suggests that any bounce in equities will be short lived and the remainder of January will continue to see selling pressure and volatility.

Breadth is at significant washout levels. Only 27% of SPX companies are now above their 200-dma. There's a good tell for the markets ahead: in a bull market, this would mark the start of a bottoming process but in a bear market, price will just keep falling lower (red lines).

Volatility spiked to the highest levels since the late August lows in equities. Many times, spikes to current levels are close to at least temporary equity lows (lines), but not always (shaded boxes).

Anything could happen to volatility here: it could turn lower and die, like early 2011 or late 2014 (in which case SPY will start a new uptrend), or it could remain high, like mid-2012 (in which case SPY will chop violently).

The term structure of volatility is now inverted (ratio over 1). When this subsides (ratio under 1), equities most often bounce or start a new uptrend. The pattern is not perfect however (yellow shading).

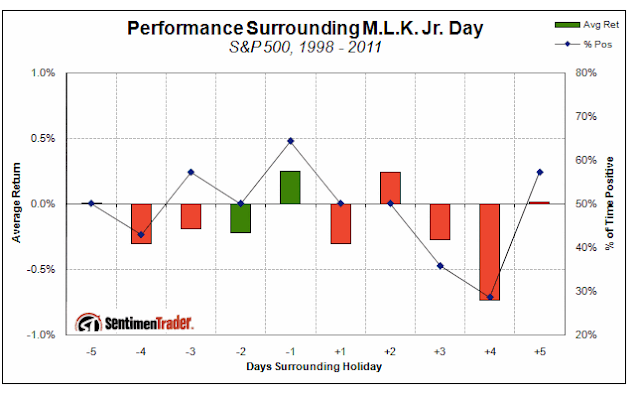

Seasonality in mid-January is usually not good, but we're hesitant to put much emphasis on that now. Early January is usually strong and it follows a typically strong end to December, so for weakness to follow makes sense. But with equities already weak, the seasonal pattern seems less likely to matter. MLK is a week from Monday (data from Sentimentrader).

We think it is unlikely that the weakness in equities is macro-related. To be sure, growth is slow, but the balance of evidence suggests that an imminent recession remains unlikely. As an example, personal consumption grew 2.5% to a new high in November. A new post on this is here.

The fall in equities has hit investor sentiment very hard. Over the past 5 weeks, the outflow from equity ETFs and funds has reached $32b. This is greater than at the recent August/September low and third only within the current bull market to March 2009 and August 2011 (data from Lipper and Sentimentrader).

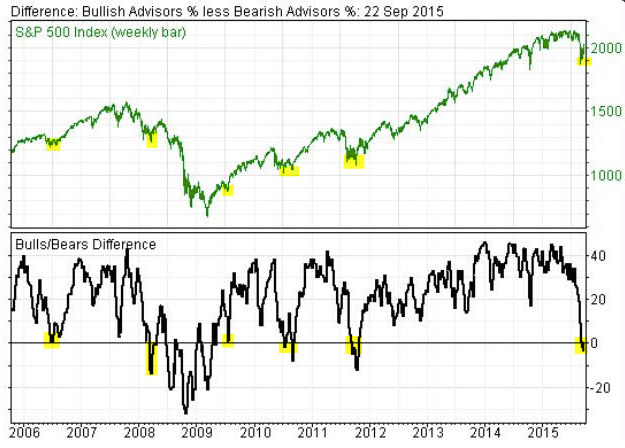

Investors Intelligence bulls minus bears is just 3%. Outside of bear markets, this level of bearishness is normally where lows start to form.

The forward returns when sentiment is at this level are very good (arrow; data from Pension Partners).

The upcoming week ends with options expiration on Friday. Also note that the 4Q corporate reporting period begins this week.

Overall, the weak start to the year (first five days: FFD) and a poor end of year rally (SCR) do not, by themselves, portent a bad year in 2016. When this combination has occurred in the past, equities have most often traded higher from February through December (data from Stock Almanac).

In summary, momentum should carry equities lower, at least intra-week. Important support levels have been broken; these are now first resistance. Breadth is washed out, similar to past lows, and investor sentiment is now very bearish. It's time to be on the lookout for the formation of a base and at least a temporary bounce higher.

If you find this post to be valuable, consider visiting a few of our sponsors who have offers that might be relevant to you.